Real estate is one of the major investment avenues for foreign companies in India, accounting for a significant share of the total FDI. Traditionally, investments in real estate sector have been restricted to PE investments. Examples of foreign companies participating in management of real estate companies are still rare. Foreign companies tended to not participate in management as it requires local expertise.

However, a few Chinese companies have shown interest in owning and operating real estate companies in India. Examples include Dalian Wanda Group, Chinese Fortune Land Development Co. Ltd (CFLD) and Country Garden. Interestingly, Chinese firms have shown interest in all segments of real estate; residential, commercial and industrial. The business models of these firms differ; while some have chosen to tie-up with local developers, others have decided not to do so. The latter have chosen to hire experienced Indian employees, who can make up for the lack of expertise.

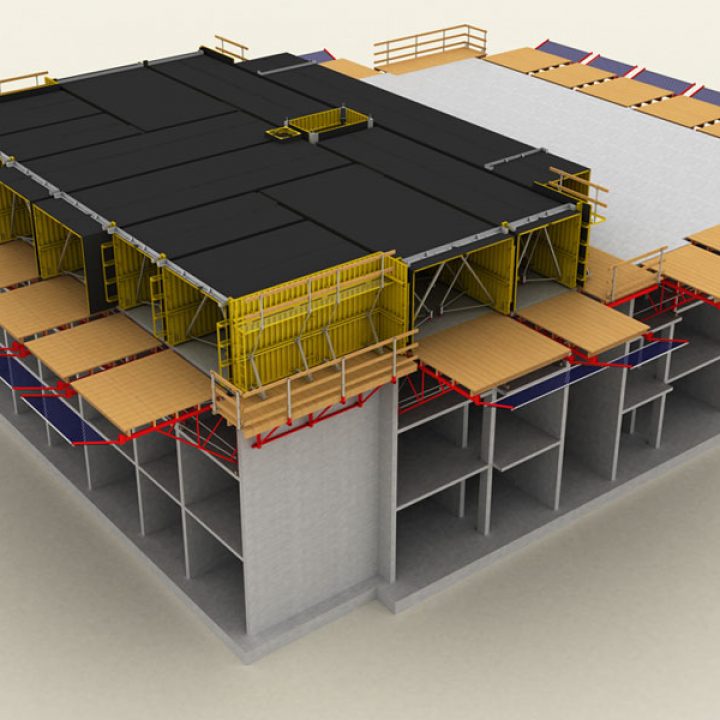

Chinese developers have vast experience in building large residential and commercial properties as well as industrial parks. Chinese firms have access to latest construction technologies that can enable faster completion of such projects thereby saving costs. Chinese firms also have access to cheaper building materials in their home country. If the required building materials can be shipped in bulk from China, there could be significant savings. If some of the costs can be passed on to the value conscious Indian buyer, it can create demand for these offerings.

Despite these advantages, there are a number of challenges that need to be overcome before Chinese developers can make their Indian ventures a success. Last but not the least, Chinese companies have access to necessary capital from their profitable ventures at home.

- Indian regulatory structure is different. Chinese companies would need to partner with local companies or hire experienced Indian employees who can navigate through this structure and comply with all laws.

- The Indian tax structure could be prohibitive for Chinese companies. The Dalian Wanda Group of China has already asked for concessions on various taxes before committing investments in India.

- Due to various reasons, the relationship between the two countries lacks trust. This could create problems for Chinese firms investing in India.

- Unbranded and even branded Chinese products are perceived to be of poor quality in India. This could be a challenge, since Indian customers may be vary of buying homes from Chinese developers.

Given the above challenges, some Chinese firms are preferring other routes of investment. Sino Great Wall International Engineering is looking setup a building materials hub in India, stocking Chinese goods. Such a hub would allow Indian companies to make purchases of Chinese building materials in India, rather than to travel to China or deal via intermediaries. Another Chinese company, Fosun, has decided to stick to the traditional Private Equity model as an investor.

In the coming 3 to 5 years, it will be interesting to see the progress of Chinese real estate firms in India. Will firms with Indian tie-up success or those who enter on their own? Will Chinese firms be successful in offering properties at lower prices? Will they prefer to enter residential, commercial or industrial segments? Time will answer these questions!