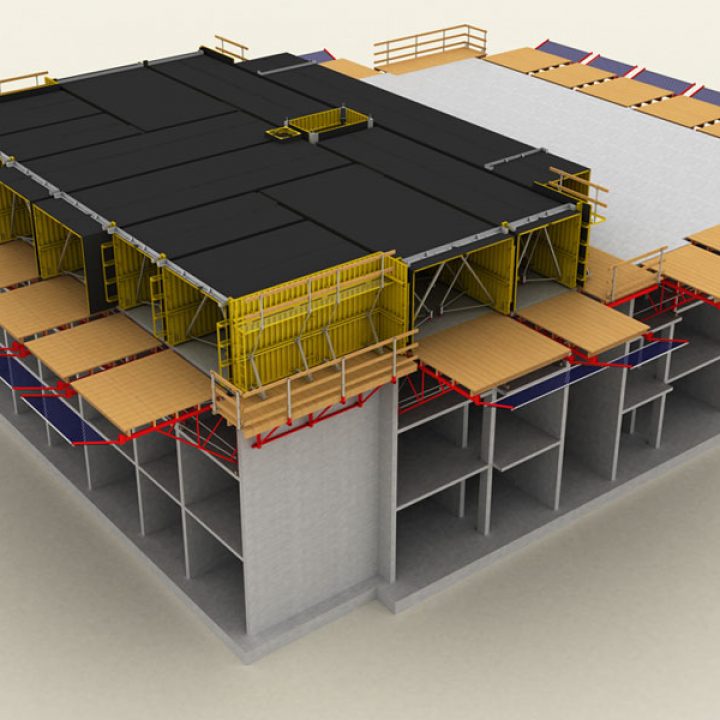

The Parliament of India passed the much delayed and awaited Goods and Services Tax (GST) Bill in 2016. From July 2017, it is expected that the entire country will move to the GST regime, a single tax for the whole of India. GST is expected to have a revolutionary impact on the way business is done. One of the key sectors in the Indian economy is real estate and construction, which contributes to around 7.8% of India’s GDP and is considered to be the second largest employment generator in the nation. What will be the impact of the GST Bill on this sector?

The Impact of GST Bill on Real Estate

- The expected growth in GDP due to implementation of GST is likely to boost demand for real estate and construction.

- Complex tax structure will become simplified to a single tax. Customers will be able to understand the tax structure better and therefore make better decisions. A simpler process could also attract more people to consider buying real estate.

- Developers will be able to avail input credits on GST paid by them. This is expected to increase tax compliance and bring greater transparency. The incidence of double taxation is also likely to reduce. Further, companies that pay taxes will be able to compete on a level or higher playing field with others who don’t. This is a positive development and will lead to consolidation of the supply side, in favour of those who have tax-compliant business practices.

Therefore, the expectation is that the bill will have a positive impact on the construction and real estate sector in India. However, much depends on the final GST rate. The rates in GST vary from 5% to 28%, with 12% and 18% being applicable to most goods and services. Companies in the sector are keen to know if the new GST rate would be lower, same or higher than the existing cumulative taxes. According to them, a higher tax rate will be a dampener as it will increase the final cost of construction and therefore higher prices for residential and non-residential buildings and infrastructure. However, some have also argued that the GST bill will benefit the industry, even if the rate is higher, due to the reasons cited above.

Whatever be the final GST rate, it will be interesting to observe the impact of GST on real estate and construction in the coming few years.

2 comments